Consequences of the First 10 Drugs Selected for Medicare’s Negotiation Program

PM360

SEPTEMBER 21, 2023

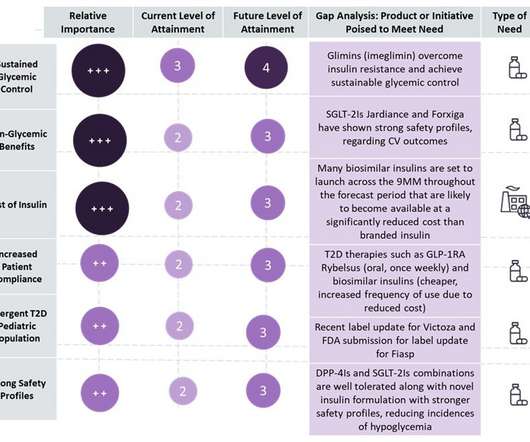

They do not have biosimilar or generic competition available in the market. The MFPs will be announced publicly in September 2024 and go into effect on January 1, 2026. Additionally, highly competitive classes, such as rapid-acting insulin and immunologics are included on the selected drug list.

Let's personalize your content